|

|

Post by coverpoint on Oct 14, 2016 20:23:52 GMT

www.chroniclelive.co.uk/sport/cricket/durham-county-cricket-club-crisis-11979869#rlabs=2%20rt$category%20p$5Why didn’t the ECB let them go bust? Partly because they were to blame (see below), and partly because Durham are one of the most prolific counties when it comes to producing England players. What have Durham done wrong? Basically they have spent money they do not have. The main reason is that when Durham were allowed to become a First-Class club in 1992 (the equivalent of going from non-league to the league in football) it was on condition that they build a ground which could host international cricket, among other things.To buy the amount of land they needed was not easy, and the Riverside was built in Chester-le-Street, a town with a population of 24,000 and not the easiest to get to. Now there are nine Test-match grounds and not enough cricket for all of them, so the ECB devised a bidding process which forced the counties to borrow and spend money they did not have so as not to lose these revenue-generating high-profile games.Are they the only ones in this mess? Many other counties have high level of debts – Yorkshire and Warwickshire’s are around three times Durham’s.

The difference is that most have city-centre grounds which are easier to attract conferences and supporters to, and have either rich benefactors (Spen Carma) or councils willing to do their best to help the county out.

|

|

|

|

Post by leedsgull on Nov 9, 2016 16:14:40 GMT

|

|

|

|

Post by flashblade on Nov 9, 2016 17:26:52 GMT

Totally agree. Some folks seem to be trying to continue their never-ending ego trip. Do we know what Mr Graves' opinion is on this? |

|

|

|

Post by coverpoint on Nov 30, 2016 19:47:08 GMT

|

|

|

|

Post by hhsussex on Nov 30, 2016 22:11:08 GMT

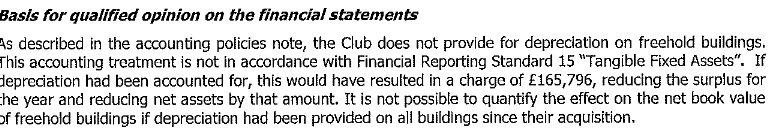

Apparently. But Somerset don't have a great record for financial transparency, their auditors having had to qualify their accounts for a number of years now because they fail to observe normal accounting conventions over the treatment of depreciation on their ground development. I've no idea if this is still true since I haven't yet been able to find a proper set of accounts to support this good news story, but the figures that have been released have a slightly odd sound to them "The 2016 accounts show a pre-tax surplus of £596,700 for the last fiscal year. Earnings before taxes, interest and depreciation were £670,111, compared with £411,681 twelve months ago." I'm sure they are a very go-ahead, very positive county club and envy them their success, and yet...I distrust these triumphal stories of the financial health of cricket clubs when the reality is of Durham with its dodgy Asian backers, Northampton's chancerish in-and-outs and Glamorgan being saved by Welsh national pride and a huge taxpayer bail out. Anyone got a good take on these figures and can comment? |

|

|

|

Post by flashblade on Dec 1, 2016 8:38:33 GMT

Apparently. But Somerset don't have a great record for financial transparency, their auditors having had to qualify their accounts for a number of years now because they fail to observe normal accounting conventions over the treatment of depreciation on their ground development. I've no idea if this is still true since I haven't yet been able to find a proper set of accounts to support this good news story, but the figures that have been released have a slightly odd sound to them "The 2016 accounts show a pre-tax surplus of £596,700 for the last fiscal year. Earnings before taxes, interest and depreciation were £670,111, compared with £411,681 twelve months ago." I'm sure they are a very go-ahead, very positive county club and envy them their success, and yet...I distrust these triumphal stories of the financial health of cricket clubs when the reality is of Durham with its dodgy Asian backers, Northampton's chancerish in-and-outs and Glamorgan being saved by Welsh national pride and a huge taxpayer bail out. Anyone got a good take on these figures and can comment? Can anyone post a link to Somerset's latest accounts, please? |

|

|

|

Post by hhsussex on Dec 1, 2016 8:44:39 GMT

Apparently. But Somerset don't have a great record for financial transparency, their auditors having had to qualify their accounts for a number of years now because they fail to observe normal accounting conventions over the treatment of depreciation on their ground development. I've no idea if this is still true since I haven't yet been able to find a proper set of accounts to support this good news story, but the figures that have been released have a slightly odd sound to them "The 2016 accounts show a pre-tax surplus of £596,700 for the last fiscal year. Earnings before taxes, interest and depreciation were £670,111, compared with £411,681 twelve months ago." I'm sure they are a very go-ahead, very positive county club and envy them their success, and yet...I distrust these triumphal stories of the financial health of cricket clubs when the reality is of Durham with its dodgy Asian backers, Northampton's chancerish in-and-outs and Glamorgan being saved by Welsh national pride and a huge taxpayer bail out. Anyone got a good take on these figures and can comment? Can anyone post a link to Somerset's latest accounts, please? Only that headline announcement is quoted on their website. The page with pdfs of Accounts has not yet been updated with the 2016 set www.somersetcountycc.co.uk/club/accounts/#JUrLLBcqtOV6hlYC.97On edit: This was last year's auditor's qualification and the respective figure on depreciation not used in compiling the accounts. Given the further development of pavilion facilities it would be surprising if this figure was not at least equalled in 2016.  |

|

|

|

Post by Wicked Cricket on Dec 1, 2016 9:53:00 GMT

I have never trusted Somerset's accounts and with the recent major ground developments, this surely creates a huge depreciation

factor to their overall sheen. Plus, there is the annual and consistent £300k gained from local parking charges and property rental...

Imho, their annual accounts are more gloss and veneer to an underlying untruth.

|

|

|

|

Post by northfan on Dec 1, 2016 11:05:06 GMT

I have never trusted Somerset's accounts and with the recent major ground developments, this surely creates a huge depreciation factor to their overall sheen. Plus, there is the annual and consistent £300k gained from local parking charges and property rental... Imho, their annual accounts are more gloss and veneer to an underlying untruth. In the 2015 accounts, the income from car parking, property rental etc is shown as £187K down from £269K the previous year. I can't see why you would think that there is anything 'iffy' about this? With regards to the depreciation question, many will argue that depreciation of freehold property is a nonsense. Depreciation is designed to write an asset off over its useful economic life so in theory a building would have a nil value in 50 years whereas in reality it would in all probability have increased in value. A periodic revaluation of the property would usually reverse any depreciation charges incurred. The one thing that did catch my eye is the note that a short term ECB loan of £1m had been converted into a capital grant! |

|

|

|

Post by flashblade on Dec 1, 2016 12:05:41 GMT

I have never trusted Somerset's accounts and with the recent major ground developments, this surely creates a huge depreciation factor to their overall sheen. Plus, there is the annual and consistent £300k gained from local parking charges and property rental... Imho, their annual accounts are more gloss and veneer to an underlying untruth. In the 2015 accounts, the income from car parking, property rental etc is shown as £187K down from £269K the previous year. I can't see why you would think that there is anything 'iffy' about this? With regards to the depreciation question, many will argue that depreciation of freehold property is a nonsense. Depreciation is designed to write an asset off over its useful economic life so in theory a building would have a nil value in 50 years whereas in reality it would in all probability have increased in value. A periodic revaluation of the property would usually reverse any depreciation charges incurred. The one thing that did catch my eye is the note that a short term ECB loan of £1m had been converted into a capital grant! Correct to say that land tends not to depreciate - but buildings certainly do. Ask any Sussex fan what state the buildings were in before the Spen Cama redevelopment! Buildings in cricket grounds not only suffer from wear and tear, but most eventually become obsolete and are demolished and replaced. |

|

|

|

Post by northfan on Dec 1, 2016 12:24:11 GMT

In the 2015 accounts, the income from car parking, property rental etc is shown as £187K down from £269K the previous year. I can't see why you would think that there is anything 'iffy' about this? With regards to the depreciation question, many will argue that depreciation of freehold property is a nonsense. Depreciation is designed to write an asset off over its useful economic life so in theory a building would have a nil value in 50 years whereas in reality it would in all probability have increased in value. A periodic revaluation of the property would usually reverse any depreciation charges incurred. The one thing that did catch my eye is the note that a short term ECB loan of £1m had been converted into a capital grant! Correct to say that land tends not to depreciate - but buildings certainly do. Ask any Sussex fan what state the buildings were in before the Spen Cama redevelopment! Buildings in cricket grounds not only suffer from wear and tear, but most eventually become obsolete and are demolished and replaced. I would agree that some buildings may well depreciate but certainly not all. If there had been a material difference in the net book value of the assets and their current valuation I'm sure the auditors would have further qualified the accounts. |

|

|

|

Post by Wicked Cricket on Dec 1, 2016 12:27:52 GMT

nf,

In the 2015 accounts, the income from car parking, property rental etc is shown as £187K down from £269K the previous year. I can't see why you would think that there is anything 'iffy' about this?

I wasn't suggesting it was.

My understanding is that the £300k is made up of parking and property rental. The former is the £187k mainly accrued from the car park site owned by the club close to the ground and the rest is rental. I must recheck the accounts. My point is more of envy where the majority of the annual club profits are garnered away from cricket. Rather like Sussex in the noughties, earning £500k+ a year from just interest on the £10.6m Spen Cama Legacy.

|

|

|

|

Post by northfan on Dec 1, 2016 12:37:36 GMT

nf,

In the 2015 accounts, the income from car parking, property rental etc is shown as £187K down from £269K the previous year. I can't see why you would think that there is anything 'iffy' about this?I wasn't suggesting it was. My understanding is that the £300k is made up of parking and property rental. The former is the £187k mainly accrued from the car park site owned by the club close to the ground and the rest is rental. I must recheck the accounts. My point is more of envy where the majority of the annual club profits are garnered away from cricket. Rather like Sussex in the noughties, earning £500k+ a year from just interest on the £10.6m Spen Cama Legacy. Apologies, I obviously misconstrued your comment that you never trusted Somerset's accounts! On a different note, see the fixtures have been kind and Sussex will have to travel to Durham for what, in all probability, will be a meaningless fixture at the end of the season. I'd love to think it could be a title decider but methinks that is wishful thinking. Looks like we'll have to have that beer at Hove in May. |

|

|

|

Post by flashblade on Dec 1, 2016 12:58:49 GMT

Correct to say that land tends not to depreciate - but buildings certainly do. Ask any Sussex fan what state the buildings were in before the Spen Cama redevelopment! Buildings in cricket grounds not only suffer from wear and tear, but most eventually become obsolete and are demolished and replaced. I would agree that some buildings may well depreciate but certainly not all. If there had been a material difference in the net book value of the assets and their current valuation I'm sure the auditors would have further qualified the accounts.There is no requirement to obtain a valuation of buildings every year. The auditors have qualified their report because Somerset have blatantly ignored a fundamental accounting standard. In my experience, this decision will have been taken in order to avoid publishing a lower, more realistic, bottom line result. They may suppose that most fans will not bother to attempt to work out the significance of the audit qualification. |

|

|

|

Post by northfan on Dec 1, 2016 13:07:32 GMT

I would agree that some buildings may well depreciate but certainly not all. If there had been a material difference in the net book value of the assets and their current valuation I'm sure the auditors would have further qualified the accounts.There is no requirement to obtain a valuation of buildings every year. The auditors have qualified their report because Somerset have blatantly ignored a fundamental accounting standard. In my experience, this decision will have been taken in order to avoid publishing a lower, more realistic, bottom line result. They may suppose that most fans will not bother to attempt to work out the significance of the audit qualification. I'm well aware of the requirements of building valuations but I still stand by my comment re material differences of asset net book value versus current market value. i obviously don't know the reason that Somerset adopt the accounting policy it does but I doubt it's to 'hoodwink' fans! |

|